The Next Economic Recession Will Wreck Millennial Parents

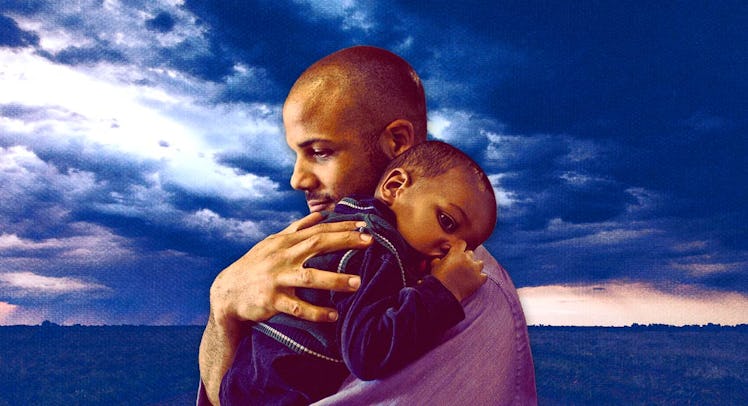

Millennials are primed to get another walloping if a recession hits soon. But millennials with kids? They're due for a bigger one.

According to the New York Federal Reserve Model, the United States has a 38 percent chance of falling into a recession over the next 12 months. This is the highest it’s been since before the Great Recession hit in 2007. Meanwhile, a trade war with China continues to drag on, the stock market just released a “volfefe” index, a measurement of how much the stock market shifts when Trump tweets, and costs of housing, cars, and raising children continue to rise while wages remain depressed from the last Great Recession.

Recessions are a normal part of any economy, but, as Annie Lowrey argued in a recent article for The Atlantic, one generation in particular stands to get hit hard if another one were to come to pass: millennials. That’s right, the generation who graduated right into the depths of the Great Recession and saw a decade of essentially lost wages as a result is poised to get hit hard again.

For those who are 22 to 38 right now, or born between 1997 and 1981, the recession has dragged on despite economic recovery: As Lowrey, noted millennial men are earning as much as Gen X men and less than Boomer men; millennial women, are earning less than Gen X women.

Not only are wages low, but ballooning student debt has led to suppressed buying power in the market. About 44 million people, many of them millennials, have about $1 trillion in student debt. Couple student debt with low wages and soaring costs of homes, cars, and stock prices? Millennials are, shall we say, pretty broke.

Just look at it this way: first time home buyers in 2001 bought their homes at the average age of 31; today, the average person who buys a home is 46, some eight years older than the oldest millennial. People under 35 just aren’t investing in the stock market, with investment down 18 percent in 17 years. Coincidentally, the costs of college have risen 100 percent since 2001. And even more troubling: 66 percent of millennials haven’t started saving for retirement, suggesting that millennials are too burdened by the costs of rent, health care, and student debt to start saving for tomorrow.

Millennials also have far less net worth than Gen X or Boomers. That will harm them, should the economy contract, especially given the fact that the youngest of the generation have just entered the job market. Thirty-five percent of millennials who responded to a survey by the Economic Innovation Group report that they make just enough money to cover their expenses; 30 percent say they do not. Only six percent of feel they make “a lot more” than required to cover their basic needs, and 63 percent would encounter difficulty covering an unexpected expense of $500. So who buys a home? Who has kids? Who decides to invest in the next Apple?

Millennials are having kids, but they’re doing it on a shoestring budget, having fewer, and doing so far later than generations that came before them. Sure, this also has to do with other facts of modern life, such as taking longer to settle down. But the fact remains: money is a big issues. Millennials are struggling to catch up, and children are expensive: It costs about $230,000 to raise a child from birth to 18, not including the costs of college, a debt that is all but guaranteed for the average middle-class American family.

A New York Times survey stated that of adults surveyed from age 20 to 45 — from the youngest millennials to the youngest of Gen X, 64 percent said their reasons for delaying having kids was that childcare was too expensive; 44 percent said they can’t afford more kids; and 43 percent said they were waiting to have kids due to their finances. This is smart economically. But no amount of scrupulousness can make up for the lack of capital that millennials have and the market, which could contract in the next 12 months, leading to layoffs and dipping into minimal savings to get by.

When the next recession hits, many millennial parents will certainly be screwed. With very little savings to support themselves in the event of a layoff (in one survey by Morning Consult, just under half of millennials say they have an emergency savings fund that could cover three months of living expenses), outstanding debt payments, and very little invested in the overall market, millennials who got hit hard in 2007 and never recovered are in for another walloping.

Parents today are forced to disinvest in other things that might grow them wealth in the long term or save them in the event of a downturn to invest in their children instead. That is what they signed up for, yes, but to combine that with millennials low level of savings and the likely downturn to come and it doesn’t paint a pretty picture.

The problem is that millennial parents are unlikely to benefit from a recession as other generations did from the Great Recession. For those who do have capital around the time the market contracts, a recession is one of the best times to invest or even to buy homes. When recessions hit, the costs associated with buying a home plummet as the housing market crashes.

When the economy ultimately recovers, things that were bought at a relative steal become wise investments. Profits soar. For example, in Long Island City, New York the median cost of a home was $285,000 in 2008. One building sold in that neighborhood for 70 percent more than the owners bought it for in 2017. That is a lot of money. It’s a good investment. And it’s one that could only be made in the pits of a recession.

Those who have the money to invest when the economy dwindles do better when it all inevitably turns around again. But this won’t be the case with millennials; they don’t have the money to buy houses now and didn’t 12 years ago. Only the well-off among them — or those with support from their wealthy parents — will be able to afford to invest when the market contracts. Given that, in 2018, 55 percent of people aged 18 to 35 were earning less than $25,000 a year, it doesn’t seem like if a recession hit that millennials would suddenly have the capital to, say, buy a house or make some wild investment that would pay dividends later on. Especially not those who are paying

So what does that mean? Millennials, and more-so millennials who are parents, are particularly in a bind. They’re likely to experience the worst of the recession and won’t be able to benefit from it. So, as the economy grows again after this downturn, they won’t be able to cash out. In other words, they’ll experience 2007 again, except they’ll be more than a decade older and perhaps have kids in tow. When these new parents go broke, it will have been decades in the making.