How the Child Tax Credit Could Become Permanent

The Child Tax Credit has hit parents bank account. Now, how do we get this policy to stick?

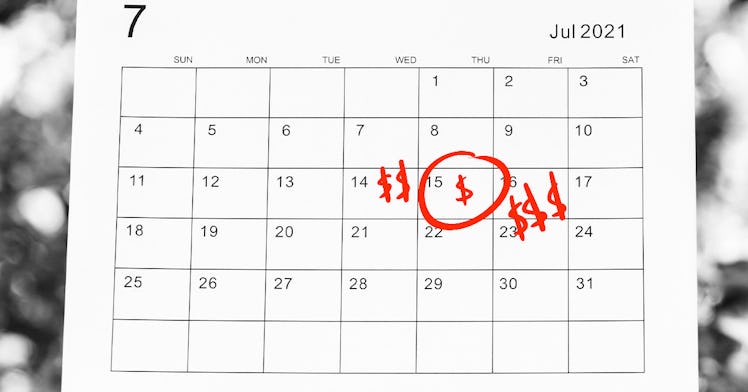

On July 15, a nearly first-of-its-kind benefit for parents in the United States will start rolling through bank accounts across the amber waves of grain. That benefit? The expanded and transformed child tax credit, signed into law under the American Rescue Plan as one of President Biden’s major policy achievements.

The new child tax credit is a far cry from the old one. Whereas parents who filed taxes in the past had access to a tax credit at filing time that was not fully refundable, and only came during tax season, the new tax credit consists of six monthly cash payments and ends with a big lump sum of the rest of the cash when you file taxes in 2022.

Parents will get up to $300 a month per kid between the ages of 0 and 6 and $250 a month for kids between 6 and 17, and nearly all parents qualify for the benefit. Some 90 percent of households with kids will see some amount of monthly cash, as the benefit is paid out in full for parents making anything from zero dollars to $150,000, and parents making up to $400,000 will still see some monthly cash.

The fact that what basically amounts to a basic income for parents is actually happening in the United States — despite a half-a-dozen serious and not-so-serious proposals from Democrats over the years, and basic income pilots across small cities in America — feels like a miracle, and yet, it’s the only proper response to a year that has decimated the incomes, savings, and livelihoods of people and parents alike.

And yet, the benefit of becoming permanent is far from a guarantee. Fatherly spoke to Chris Hughes, who co-founded Facebook and led President Obama’s digital campaign for president, who is now a co-founder of the Economic Security Project, a non-profit “working to make the modern economy more dynamic and fair.”

Much of that work, per Hughes himself, is in making sure that no child lives in poverty in the United States — and this tax credit is a good start, given that it’s estimated to cut the child poverty rate in half. Hughes spoke to us ahead of Child Tax Credit day (July 15th!) to get the word out about the life-changing benefit and what parents need to do to access it (probably nothing!)

Obviously, the Child Tax Credit, which will pay parents hundreds of dollars of no-strings-attached cash in direct deposit form, represents a huge step forward in terms of policy that helps American families. But more importantly than that, how will this new benefit help parents?

The scale of this is just really remarkable. You’re talking about nearly 90 percent of children in the United States benefiting from recurring, monthly, cash payments, to help kids have the care that they need and to help parents pay for it.

Anybody who is reading Fatherly or, really, who is awake in the world, knows that child care expenses have just increased exorbitantly over the past few years. In a lot of metropolitan regions, it can be one of the top costs for families, alongside housing and other basics.

So, the fact that most families are going to be getting 300 dollars a month per child is a really remarkable amount of money, and should go a long way to helping them make ends meet.

You brought up child care. Are there other ways this policy may help families that may not be so obvious?

The thing about cash is that it’s fungible, which means that when families get it, they can spend it on what they most need. You from a lot of other similar cash transfer programs, that the money goes to things like child care, to housing costs, to food. Sometimes, to help pay off bills. And, the fact that it is flexible, I think, is a real feature, not a bug, of the benefit.

Right.

Because no two families are alike, and even though child care expenses are very difficult for many, some families might have a parent that stays home and handles child care and so this money then would help replace some of the income that’s been lost. So, it provides that flexibility.

I should say that I think [the child tax credit benefit] should go alongside universal child care as something middle-class Americans can benefit from. The two things would be really smartly paired together, because then you bring down the cost of child care, and make it so it’s easier for more parents to afford it, and probably have more kids as a result.

Yeah. It’s funny that you mention that the universality, and freedom, of cash benefits is a feature of the program, not a bug. I was immediately thinking of a survey I saw of a couple of thousand Americans, that a good amount of parents were planning on saving the money. For people who don’t need to spend it immediately, that’s also about financial stability — when you think of how many Americans can’t afford a 400 dollar emergency expense. It’s like, even just saving that money is such a benefit for parents of kids.

Yeah. And particularly in this period, too, when jobs are increasingly plentiful, and the economy is moving along nicely, this is a time when a lot of families may choose to save the money to help them weather future turbulence. That makes sense.

I do think, though, the irony is that even though jobs are plentiful, and the economy is humming along, that child care is still so exorbitantly expensive, is an argument for [the cash benefits.]

Because when you look at what happens, and this is similar to what some of the other cash transfer programs that we’ve seen over the past year, it’s that, some families will save. But, particularly, the poorest families will spend it relatively quickly. They are the ones under the most pressure to afford child care in the first place.

I study economics, and I tend to think about these things in graphs and charts, but just thinking about it anecdotally, even if you have a hot job market, if you can’t find child care for your kids, you can’t go participate in that hot job market, and go get a job, because it’s a chicken and egg kind of problem.

So, I think what we see is that when people have these funds, it enables them to go interview for jobs or have the gas money to get out there, in many cases. So, that’s what I would expect to see.

Right. America is infamous, I would say, for its lack of support for parents among wealthy nations. Do you see this child tax credit as a bucking of the trend? Do you think it’s showing how the conversation around how the government should support parenting is changing?

I think the pandemic has shown a spotlight on this. I think parents were superheroes in many ways before the pandemic, but in the midst of the pandemic, it has just been very difficult for families to try to work, take care of kids, to [dealing with] schools and daycares [being] closed, to be teachers and friends, and parents, and in some cases, nurses, all at once. We’ve never asked more from parents and families than we have in the past year or more. And the emphasis in public policy on that is a reflection of that awareness.

I hope it is a turning point, but to be honest, I think it’s too early to tell. I think there’s a pretty heated debate happening in Washington around making this guaranteed income for families permanent, or not, along with other child care things.

So, I don’t have a crystal ball, I don’t know where it’s going to end up, but I do think that it is hard when you’ve provided this for families for six months and then, with the lump sum [parents will get at tax time] it’s going to be harder, to say, “Well, now we’re stopping!”

Because people will begin to rely upon it and get used to it just like we do any other source of income in our lives.

You don’t have a crystal ball, yes, but do you think the child tax credit has a serious chance of becoming permanent? To your point, it’s a bit like the Medicaid expansions, which become overwhelmingly popular in red states when they’re offered because they, well, help people. Once you give people something good, necessary social safety net policy, it does seem harder to take it away.

And this is such a broad group of people [that the benefit is helping.] I think that’s really important, too. You’re looking at something that will benefit, at the full amount, families making up to $150,000 a year, but a partial amount will go to families who make up to $400,000 dollars, which is, you know, part of that.

That’s significant!

Yeah. It’s at the top of the income spectrum. So you’re talking about helping people of all income levels, races, backgrounds, political affiliations. It’s a very broad benefit, which I think is great. It will make it more likely to be resilient in the long term.

What is next for the ESP, in terms of helping American families?

I think that doing this so that it’s permanent is our near-term focus. And then, assuming that happens, which I think is still an open question, then it will be expanding it, and ensuring it doesn’t get dismantled. Our focus, as an organization, is on supporting policies that help structure the economy so that they create prosperity for everybody.

That’s a very broad mission statement, but in practice, one of the ways that plays out is ensuring that we at least reduce poverty, if not erase poverty through recurring cash payments. So, that’s why, when we take a step back, when we look at what’s going on here, we effectively see an income pour for families in the United States and a really significant one. So, hopefully, this can be made permanent.

Right. And this program will massively reduce child poverty.

Yeah. Assuming that everyone takes advantage of it, it’s estimated that it will reduce child poverty by half. Which is fantastic. But every time I hear that, you know, I think, that’s wonderful progress, and now we gotta move on to the next half.

Right.

We can make economic and moral arguments for ending child poverty, but there’s really no reason for a child to grow up in poverty in the United States in 2021.

I agree with you. You mentioned that the success of the program in reducing child poverty will depend on people taking advantage of it. What did you mean by that, and what do you want people to know about the child tax credit?

Most people will get this automatically, is the good news. If you filed taxes in 2019 or 2020, or you got your stimulus payment, you’ll get it automatically, which I think is a real testament to the government working for people.

It’s easy to know all the ways when the government messes things up, but coming off the heels of pretty effective vaccine distribution, this will be another example of the government working for people, by getting these payments quickly and seamlessly.

People, however, who do not file taxes — some people don’t pay federal income tax because they make so little money — those folks will need to interface with the IRS to make sure that they are able to benefit from the program. We are just making sure that there’s visibility and messaging to people so that they know they can take advantage of it.

Is there anything that parents can do to help fight to make this thing permanent?

They need to contact their representative, whether they are Democrats or Republicans, and making that clear, is at the top of the list. This is going to reach a lot of people, and a lot of people aren’t aware of it. So they’ll definitely get aware of it really fast over the next few months and we have to connect that awareness to say, “Hey, representative, thank you, and also, I’m expecting you to make it permanent.” I think those messages need to come through.