Study Shows Which States Benefited the Most From the Child Tax Credit

Overwhelmingly, parents were using the money to put food on the table and a roof over their kids' heads.

The Child Tax Credit, a first-of-its-kind cash benefit program that gave monthly cash to parents of kids between 0 to 18 from July to December, was a major lifeline during the economic disruption of COVID-19 — an economic disruption that is, by the way, still going, even if the cash benefit has disappeared (at least for now.)

The money, a few hundred dollars per kid per month, was used for rent, clothing, and utilities, and to pay down debts. This tax credit was put to good use, necessary financial protection for millions of families. It reduced child poverty and child hunger significantly. But it’s now gone. But what states across the country benefitted the most from the cash payments? What states stand to lose the most from its sudden disappearance? Well, most of them, it turns out, as even the least reliant state had more than half of its parents saying they needed the cash.

Early data from the program saw that low-income families used the extra money to pay for vital essentials and day-to-day needs. Even parents who are middle or high income used the tax credit for everyday things like food, rent, and clothes. Now, a new study from MagnifyMoney shows that some states needed the child tax credit “more urgently than others.” With this, the credit program’s expiration has had a significantly negative impact on some states more than others.

To find out which states benefited the most from the Child Tax Credit, researchers analyzed U.S. Census Bureau Household Pulse Survey data from December 1 to December 13, 2021. “The survey asked respondents whether they or anyone in their household received a child tax credit payment in the past four weeks,” MagnifyMoney explains.

The survey “then asked whether respondents mostly saved it, mostly spent it, or mostly used it to pay off debt. Lastly, it asked about specific spending categories, including food, clothing, and charitable donations.”

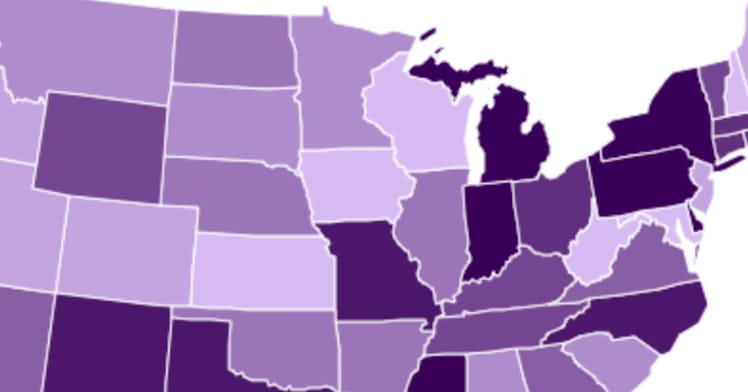

The map shows the states that needed the most help as those with the darkest colors — Mississippi, for example, had 89.9 percent of families who said they urgently needed the tax credit money, followed by Indiana and Pennsylvania. States that needed the tax credit the least are denoted by lighter colors — New Hampshire, Wisconsin, and, apparently, West Virginia, the data states. (For what it’s worth, other data has shown that 346,000 families were relying on the child tax credit and found it “crucial” in the coal-state that is represented by Senator Joe Manchin.)

MagnifyMoney / U.S. Census Bureau Data

And all the same, needing the help “the least” didn’t mean only a few parents needed the cash. In West Virginia, all the same, 59.8 percent of parents still said they urgently needed the cash — which means that needing it or relying on it “the least” isn’t all that helpful of a marker. Instead, it might be best to consider this: more than half of parents in every single state — sometimes up to 90 percent of parents in the states across the country — really, really needed that monthly cash, and likely still do. And yet, it’s disappeared regardless. (For full access to the interactive map, go here.)

One thing is very clear though: the Child Tax Credits were a necessary program for families across the country and with it expiring, so many parents and kids are now going without – while we’re still in a pandemic.

“The restart of those advance payments in 2022 would continue that help, which is still important for many families who are still unable to work due to pandemic-related issues,” DepositAccounts founder Ken Tumin says.

Unfortunately, the chances of the Child Tax Credit coming back anytime soon seem very slim.