This Map Shows Just How Much Home You Can Afford in Each State

There are only three states where over half of residents can afford the median price of a home.

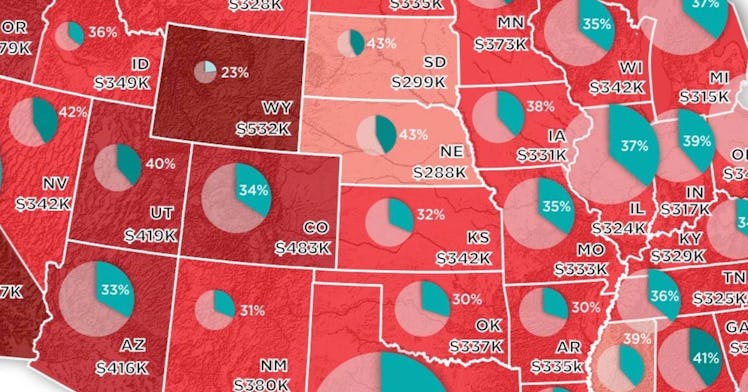

Owning a home used to be the foundation of the American Dream. However, for an increasing number of Americans, it feels more like an unattainable fantasy. And an interactive map from howmuch.net paints a picture of how difficult homeownership from sea to shining sea, as it shows the median price of a home in all 50 states (plus DC), along with what percentage of the state’s population can afford a mortgage payment of that price. The data will… probably bum you out a little bit.

The map reveals that there are only three states where more than half of the residents can afford the median home price, including Delaware (69% can afford a $193,000 home), Maryland (57% can afford a $324k home), and Virginia (54% can afford a $317,000 home). New Jersey almost reaches half, with 48% of residents being able to afford a $318,000 home. No other states on the map reach above 45% of the residents being able to afford the median cost home in that state.

Vermont is the state where the least amount of residents can afford the median price of a house, as only 16% can afford a $476,000 home. In Connecticut, only 21% of residents can afford a $590,000 home, in Wyoming, 23% can afford a $532,000 home, in New Hampshire, 24% can afford a $505,000 home, and Maine, where 25% can afford a $437,000 home, rounding out the rest of the top five.

And while all of that is wildly interesting, what’s perhaps the most interesting is how expensive houses are in general. There is only one state on the map, Delaware, where the median cost of a home is less than $200,000. Nebraska and South Dakota are the two other states where the median cost of a home is between $200,000 and $299,000. In every other state in the country, the median cost of a home is above $300,000, and in more than a handful of states, well above $400,000.

The map also shows that wages can be just as important to one’s ability to afford a home as the price of the house itself, as California, the state with the highest minimum wage in the country, also has 33 percent of residents able to afford the median cost of a home. That’s almost identical to the number of residents that can afford a median-priced home as Arizona (33%), Colorado (34%), and Kansas (32%) despite the fact that the median price of a home is significantly higher in California than any of those states.

In general, the map makes it clear that for a majority of Americans, homeownership is simply not realistic at this point in time, and barring some major financial changes in our wages and in housing costs, it may never be something the average American can afford.