What States Pay The Most in Property Taxes? This Map Will Surprise You

The average US household spends $2,471 on property taxes per year.

If you’ve been feeling the wallet pinch lately, you’re not alone. Between the impact of COVID-19 and the measures needed to keep our hospital system afloat and the inflation that’s tied to it, everything is more expensive. The extra cost of milk, meat, toys, and babysitters means we’re looking for ways to save money anywhere we can get it. This means some families are packing up and moving to a new state where they can better afford to live a balanced happy life. If that’s something you’re toying with, — and you’re wondering what state would be the most affordable when it comes to property tax — new research will help you figure out where to avoid.

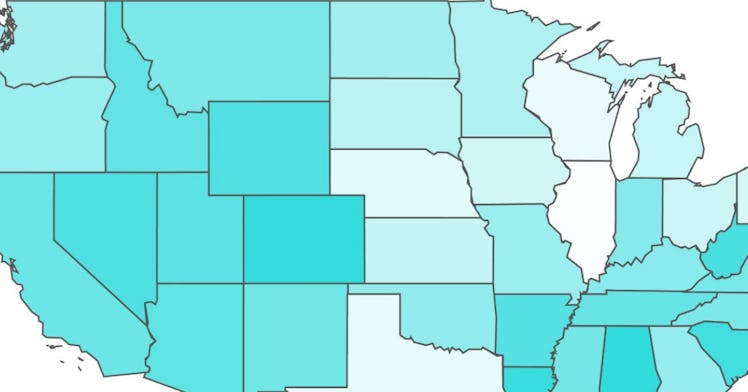

WalletHub wanted to determine which states pay the most in property taxes. WalletHub compared the 50 states and the District of Columbia using U.S. Census Bureau data to determine the highest and lowest property taxes rates.

“The average American household spends $2,471 on property taxes for their homes each year, according to the U.S. Census Bureau, and residents of the 27 states with vehicle property taxes shell out another $445,” WalletHub writes. “Considering these figures and the massive amount of debt in America, it should come as no surprise that more than $14 billion in property taxes go unpaid each year, according to the National Tax Lien Association.”

Source: WalletHub

So which states pay the most in and which pays the least? We were honestly surprised.

States that pay the most in property taxes:

- New Jersey

- Illinois

- New Hampshire

- Connecticut

- Vermont

- Wisconsin

- Texas

- New York

- Nebraska

- Rhode Island

States that pay the least in property taxes:

- Hawaii

- Alabama

- Colorado

- Louisiana

- District of Columbia

- South Carolina

- Delaware

- West Virginia

- Nevada

- Wyoming

There are many other factors that should be considered before moving to a new state — obviously, Hawaii is an extremely expensive state to live in, for example, and Vermont is much cheaper, so it’s not just about property taxes — in hopes of it being more affordable. But this is a good metric to add into the mix while you’re researching and deciding.